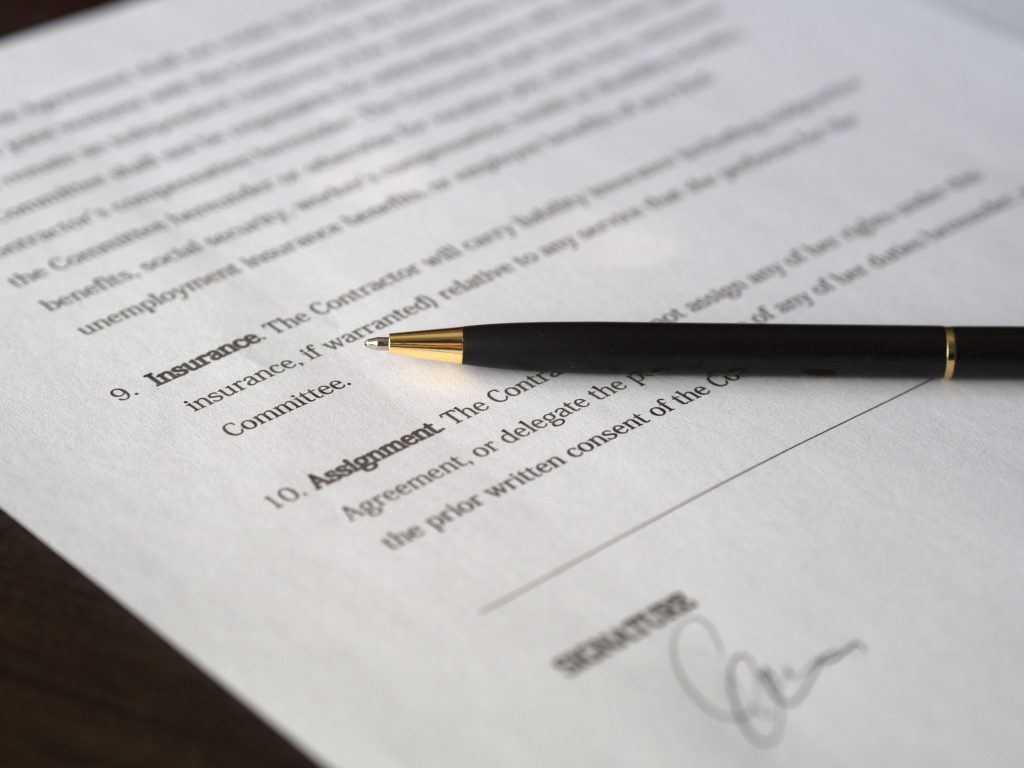

When you sign a settlement agreement and release, it is easy to assume you waived all rights to sue over the incident that led to the agreement. However, there are certain circumstances where you should have been provided with relevant information at the time of signing. Therefore, it is crucial to understand your rights and the terms of any agreement. Consulting with a qualified attorney can ensure you are fully informed before signing.

When you sign a settlement agreement and release, it is easy to assume you waived all rights to sue over the incident that led to the agreement. However, there are certain circumstances where you should have been provided with relevant information at the time of signing. Therefore, it is crucial to understand your rights and the terms of any agreement. Consulting with a qualified attorney can ensure you are fully informed before signing.

Russell Charles was driving a vehicle while pulling a trailer on I-10 in Iberville Parish, Louisiana. A Dodge Ram truck driven by Mark Moore hit Charles from behind. Moore owned the Dodge Ram truck through his company, Moore Leasing, LLC, which State Farm insured. After the accident, Moore signed an affidavit stating that he was not working at the time of the accident and that only the State Farm insurance policy would provide coverage to Charles. In addition, Charles and his wife, Consandra, signed a release against all persons, firms, or corporations who were or might be liable for the accident in exchange for $50,000.

Later, the Charleses filed a lawsuit against three companies owned by Moore and his wife, claiming that Moore had been working at the time of the accident, which would make the corporations vicariously liable. The company’s insurer was later added as a defendant. The defendants filed a motion for summary judgment, arguing that Moore had not been working at the time of the accident and that the previous release prevented this lawsuit. The trial court granted the motion and dismissed Charleses’ claims, but they appealed the decision.

Louisiana Personal Injury Lawyer Blog

Louisiana Personal Injury Lawyer Blog

To avoid a lengthy trial, many lawsuits will be solved through settlements. Settlements may have their requirements, like signing a release. If presented with a release make sure you read it carefully and ensure it includes limiting language if other parties may be at fault. This is a lesson learned by Raymond Cressy when he signed a release form through his power attorney, severely hurting his claims.

To avoid a lengthy trial, many lawsuits will be solved through settlements. Settlements may have their requirements, like signing a release. If presented with a release make sure you read it carefully and ensure it includes limiting language if other parties may be at fault. This is a lesson learned by Raymond Cressy when he signed a release form through his power attorney, severely hurting his claims.  Protection from on-the-job injury is vital to any employee, especially those doing manual labor. But when so many types and subtypes of insurance coverage are involved in a single policy, how can you know when you’re covered? And what happens when you can’t tell if specific coverage applies to you? Can you still get protection and justice?

Protection from on-the-job injury is vital to any employee, especially those doing manual labor. But when so many types and subtypes of insurance coverage are involved in a single policy, how can you know when you’re covered? And what happens when you can’t tell if specific coverage applies to you? Can you still get protection and justice? One’s life is forever altered after an incapacitating injury. While the situation comes with enough issues, problems are enhanced when medical providers merge and change the disability benefits you have relied upon for a year. Unfortunately, this is precisely what happened to Michael Swinea after

One’s life is forever altered after an incapacitating injury. While the situation comes with enough issues, problems are enhanced when medical providers merge and change the disability benefits you have relied upon for a year. Unfortunately, this is precisely what happened to Michael Swinea after  Driving while on the job can be a common occurrence for many employees. Sometimes you may even use your personal vehicle on a workplace errand. If so, beware; Accidents happen, and your employer’s insurance may not cover you.

Driving while on the job can be a common occurrence for many employees. Sometimes you may even use your personal vehicle on a workplace errand. If so, beware; Accidents happen, and your employer’s insurance may not cover you.  Generally, when you ask an insurance agent for a specific policy, you expect them to honor your request. But what happens when your insurance agent doesn’t procure the coverage you requested for? The following case is an example of a property owner who believed he maintained insurance when he did not.

Generally, when you ask an insurance agent for a specific policy, you expect them to honor your request. But what happens when your insurance agent doesn’t procure the coverage you requested for? The following case is an example of a property owner who believed he maintained insurance when he did not.  Have you ever been involved in a car accident that potentially involved two states and wondered which state’s laws would govern your personal injury lawsuit? Say, you have an insurance policy issued in Texas, and you get into a car wreck in Louisiana. Which state’s laws will apply if you file a lawsuit related to the accident? The following case shows how Louisiana Courts use a choice of law analysis to determine what state laws should apply in these situations.

Have you ever been involved in a car accident that potentially involved two states and wondered which state’s laws would govern your personal injury lawsuit? Say, you have an insurance policy issued in Texas, and you get into a car wreck in Louisiana. Which state’s laws will apply if you file a lawsuit related to the accident? The following case shows how Louisiana Courts use a choice of law analysis to determine what state laws should apply in these situations.  Automotive accidents can cause severe injuries to those involved. However, the testimony of accident reconstruction experts can help juries determine what happened and come to the correct conclusions about liability. The following lawsuit out of Baton Rouge shows how an accident reconstruction expert can help you win your automobile accident lawsuit.

Automotive accidents can cause severe injuries to those involved. However, the testimony of accident reconstruction experts can help juries determine what happened and come to the correct conclusions about liability. The following lawsuit out of Baton Rouge shows how an accident reconstruction expert can help you win your automobile accident lawsuit. Personal injury cases can be costly for all parties involved. Paying those costs can get confusing, especially when there is indemnification. Indemnification arises when a party is contractually obligated to foot the bill for attorney fees and defense costs. The question then arises, can you seek indemnification if fault was never established? This type of contractual clause and legal questions are the core issue in a recent appeal discussed below.

Personal injury cases can be costly for all parties involved. Paying those costs can get confusing, especially when there is indemnification. Indemnification arises when a party is contractually obligated to foot the bill for attorney fees and defense costs. The question then arises, can you seek indemnification if fault was never established? This type of contractual clause and legal questions are the core issue in a recent appeal discussed below.  Auto insurance can be beneficial when you are in a car accident. However, it isn’t uncommon to have specific provisions in your insurance policy that can limit your coverage. A recent case out of Kenner, Louisiana, interpreted whether certain caveats in an insurance policy can limit a client’s uninsured motorist coverage (UM/UIM).

Auto insurance can be beneficial when you are in a car accident. However, it isn’t uncommon to have specific provisions in your insurance policy that can limit your coverage. A recent case out of Kenner, Louisiana, interpreted whether certain caveats in an insurance policy can limit a client’s uninsured motorist coverage (UM/UIM).