Under Louisiana civil procedure, it is well settled that “proper citation is the cornerstone of all actions.” If a party to an action is not served with process in the manner required by law, the result of that action is considered null and void. This requirement is intended to ensure that the defendant in a lawsuit is fully informed of the existence and subject of the plaintiff’s complaint. The concept of proper service is so essential, in fact, that even a defendant’s actual knowledge of a legal action cannot correct a defective citation and service of process. Therefore, a key skill of the attorney that you hire to represent you is a thorough understanding of the various and sometimes complex rules that control how process must be served on the defendant(s) in your lawsuit.

Under Louisiana civil procedure, it is well settled that “proper citation is the cornerstone of all actions.” If a party to an action is not served with process in the manner required by law, the result of that action is considered null and void. This requirement is intended to ensure that the defendant in a lawsuit is fully informed of the existence and subject of the plaintiff’s complaint. The concept of proper service is so essential, in fact, that even a defendant’s actual knowledge of a legal action cannot correct a defective citation and service of process. Therefore, a key skill of the attorney that you hire to represent you is a thorough understanding of the various and sometimes complex rules that control how process must be served on the defendant(s) in your lawsuit.

An attorney’s command of the requirements of process service is especially crucial in disputes over a deceased person’s property. The following case of Martin v. Martin in the Second Circuit Court of Appeal is instructive. In that case, two of the adult children of John Martin, Sr. objected to his donation of his home in West Monroe to his third child, John Martin, Jr. By the time the lawsuit was filed, however, both John Sr. and John Jr. had passed away, leaving the title to the home in the name of John Jr.’s widow, Sharon Martin. The Martin siblings filed their action against Sharon personally and against the “unopened succession of John Alexander Martin, Jr.” for which no succession representative (also known as an executor) had yet been identified. Nevertheless, Sharon Martin answered “individually and as testimony [sic] legatee,” despite never being identified as the succession representative of her late husband’s estate. From there, the trial court considered the Martin siblings’ objections to John Sr.’s gift, including that John Sr. was not of sound mind and lacked the capacity to make the gift, and that the gift should be declared invalid because it left John Sr. without means of support. Ultimately, the trial court found in favor of the siblings.

On appeal, however, the Second Circuit focused its attention on a more fundamental question: whether Sharon Martin had standing to represent the unopened succession of her late husband. Under state law, one cannot bring an action against an unopened succession for which no representative has been appointed. See Minden Bank & Trust Co. v. Childs, 658 So. 2d 216 – La: Court of Appeals, 2nd Circuit 1995. Accordingly, the court reviewed the formal requirements in Louisiana for appointing a succession representative — including furnishing a security and taking the oath of office — after which the clerk issues the representative letters of administration. And, although the law provides a specific procedure for filing a suit against a deceased person for whom no succession representative has been appointed, ( see La. C.C.P. art. 5091) the Martin siblings did not make use of it. Therefore, the court concluded, there was “no showing that Sharon was ever appointed as the succession representative,” as there was “no proof in this record that she had been recognized by any court of this state as the succession representative.”

When a person is injured and left in a condition where they cannot handle their legal claims, their family may act on the incapacitated person’s behalf. If a family member is handling claims on behalf of the incapacitated, it is very important for them to find a good lawyer to help navigate the legal processes. The following appeal of a lawsuit arising out of New Orleans discusses what can occur when multiple lawsuits are filed as a result of disastrous injuries caused by an eighteen wheeler.

When a person is injured and left in a condition where they cannot handle their legal claims, their family may act on the incapacitated person’s behalf. If a family member is handling claims on behalf of the incapacitated, it is very important for them to find a good lawyer to help navigate the legal processes. The following appeal of a lawsuit arising out of New Orleans discusses what can occur when multiple lawsuits are filed as a result of disastrous injuries caused by an eighteen wheeler. Louisiana Personal Injury Lawyer Blog

Louisiana Personal Injury Lawyer Blog

The Jones Act is a set of federal rules that protects American workers injured while working at sea. Also referred to as the Merchant Marine Act of 1920, this law allows qualifying sailors who have been involved in accidents or become sick while performing their duties to recover compensation from their employers. So does everyone that is injured or who becomes sick while working offshore automatically qualify for benefits under the Jones Act? Not always. In the following case that stems from an oil platform injury we see how the courts evaluate the seaman status (status necessary to receive benefits) under the Jones Act.

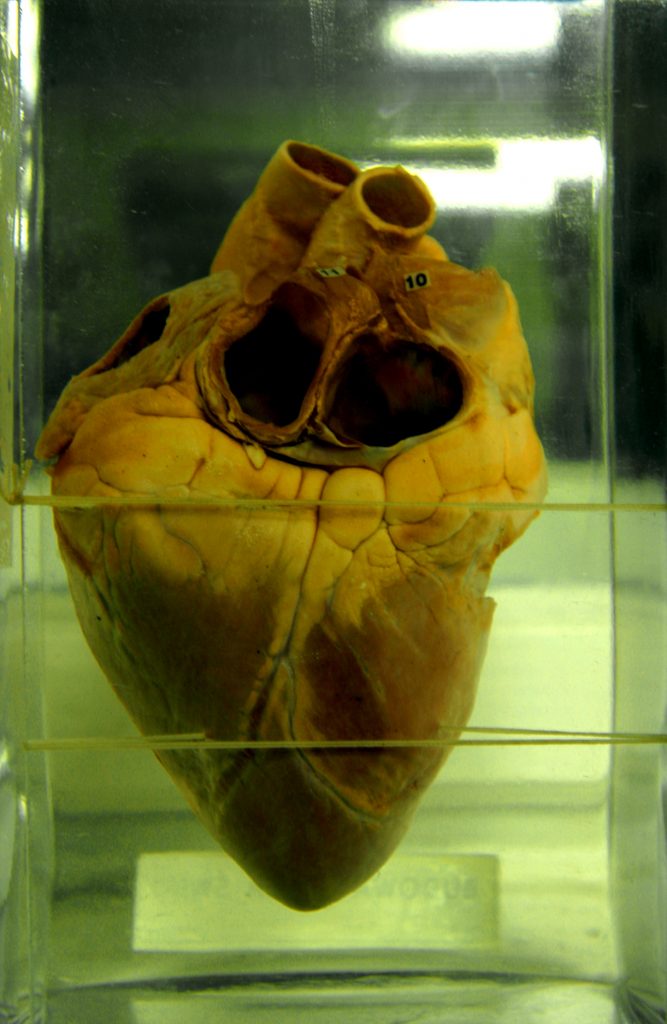

The Jones Act is a set of federal rules that protects American workers injured while working at sea. Also referred to as the Merchant Marine Act of 1920, this law allows qualifying sailors who have been involved in accidents or become sick while performing their duties to recover compensation from their employers. So does everyone that is injured or who becomes sick while working offshore automatically qualify for benefits under the Jones Act? Not always. In the following case that stems from an oil platform injury we see how the courts evaluate the seaman status (status necessary to receive benefits) under the Jones Act. Inferior vena cava (IVC) filters were designed and sold as a supposedly secure fallback to help avert pulmonary embolism for patients who for various medical reasons could not take blood thinners. Unfortunately for over the last ten years these filters have continuously been alleged to have been at fault for adverse conditions due to breaking of the filter. The best IVC filter lawyers have been pursuing these claims on behalf of their clients for several years now. While you can get a full run down of this litigation from a Louisiana IVC filter claim lawyer here,

Inferior vena cava (IVC) filters were designed and sold as a supposedly secure fallback to help avert pulmonary embolism for patients who for various medical reasons could not take blood thinners. Unfortunately for over the last ten years these filters have continuously been alleged to have been at fault for adverse conditions due to breaking of the filter. The best IVC filter lawyers have been pursuing these claims on behalf of their clients for several years now. While you can get a full run down of this litigation from a Louisiana IVC filter claim lawyer here,

Being involved in an automobile accident or sustaining a serious injury can be very overwhelming. This is especially true if the accident was someone else’s fault. Although one may be disoriented after an automobile accident, it is pertinent that he/she follows all the necessary steps to ensure that the accident or injury is well documented. One’s first instinct may be to try to minimize the gravity of the situation; however, it is important to understand that a personal injury may have been sustained even if the symptoms are not immediately visible. One never knows if they will have a problem down the road from an injury sustained from the automobile accident, and therefore, a great attorney knows that their client will need proof and documentation to prove that the problem stems directly from the said automobile accident.

Being involved in an automobile accident or sustaining a serious injury can be very overwhelming. This is especially true if the accident was someone else’s fault. Although one may be disoriented after an automobile accident, it is pertinent that he/she follows all the necessary steps to ensure that the accident or injury is well documented. One’s first instinct may be to try to minimize the gravity of the situation; however, it is important to understand that a personal injury may have been sustained even if the symptoms are not immediately visible. One never knows if they will have a problem down the road from an injury sustained from the automobile accident, and therefore, a great attorney knows that their client will need proof and documentation to prove that the problem stems directly from the said automobile accident.

Under Louisiana civil procedure, it is well settled that “proper citation is the cornerstone of all actions.” If a party to an action is not served with process in the manner required by law, the result of that action is considered null and void. This requirement is intended to ensure that the defendant in a lawsuit is fully informed of the existence and subject of the plaintiff’s complaint. The concept of proper service is so essential, in fact, that even a defendant’s actual knowledge of a legal action cannot correct a defective citation and service of process. Therefore, a key skill of the attorney that you hire to represent you is a thorough understanding of the various and sometimes complex rules that control how process must be served on the defendant(s) in your lawsuit.

Under Louisiana civil procedure, it is well settled that “proper citation is the cornerstone of all actions.” If a party to an action is not served with process in the manner required by law, the result of that action is considered null and void. This requirement is intended to ensure that the defendant in a lawsuit is fully informed of the existence and subject of the plaintiff’s complaint. The concept of proper service is so essential, in fact, that even a defendant’s actual knowledge of a legal action cannot correct a defective citation and service of process. Therefore, a key skill of the attorney that you hire to represent you is a thorough understanding of the various and sometimes complex rules that control how process must be served on the defendant(s) in your lawsuit. No one wants to ever get involved in a slip-and-fall lawsuit. If your unfortunate enough to be injured in a slip and fall finding out who is responsible to pay for your injuries can become a troublesome matter. A recent Louisiana Fourth Circuit Court of Appeal opinion demonstrates just how complicated these lawsuits can get when a woman alleged she slipped and fell in the China Palace restaurant on South Carrolton Avenue in New Orleans.

No one wants to ever get involved in a slip-and-fall lawsuit. If your unfortunate enough to be injured in a slip and fall finding out who is responsible to pay for your injuries can become a troublesome matter. A recent Louisiana Fourth Circuit Court of Appeal opinion demonstrates just how complicated these lawsuits can get when a woman alleged she slipped and fell in the China Palace restaurant on South Carrolton Avenue in New Orleans.  Buying a car is a huge endeavor for most people. Most of the time we do our due diligence and make sure we have a fair understanding of what we are purchasing. However, only so much information is under of our control. When buying a used car, we are often forced to go off of what the seller tells us about the vehicle. This can be nerve racking for many. It’s safe to say that the nerves tend to lessen when we are buying a used car from a certified pre-owned dealership, and the car is under warranty. Unfortunately, for two Louisiana men, a truck under warranty purchased from a reputable dealership caused more problems than were conceivable.

Buying a car is a huge endeavor for most people. Most of the time we do our due diligence and make sure we have a fair understanding of what we are purchasing. However, only so much information is under of our control. When buying a used car, we are often forced to go off of what the seller tells us about the vehicle. This can be nerve racking for many. It’s safe to say that the nerves tend to lessen when we are buying a used car from a certified pre-owned dealership, and the car is under warranty. Unfortunately, for two Louisiana men, a truck under warranty purchased from a reputable dealership caused more problems than were conceivable.